The term “Raid in Indian Taxes Law” is incredulous and any unexpected encounter with IT sleuths generally for you to chaos and vacuity. If you could very well experience such action it is better to familiarise with the subject, so that, the situation can be faced with confidence and serenity. Income tax Raid is conducted with the sole objective to unearth tax avoidance. It is the process which authorizes IT department searching any residential / business premises, vehicles and bank lockers etc. and seize the accounts, stocks and valuables.

The federal income tax statutes echos the language of the 16th amendment in nevertheless it reaches “all income from whatever source derived,” (26 USC s. 61) including criminal enterprises; criminals who for you to report their income accurately have been successfully prosecuted for xnxx. Since the text of the amendment is clearly developed to restrict the jurisdiction of the courts, end up being not immediately clear why the courts emphasize the words “all income” and forget about the derivation on the entire phrase to interpret this section – except to reach a desired political lead to.

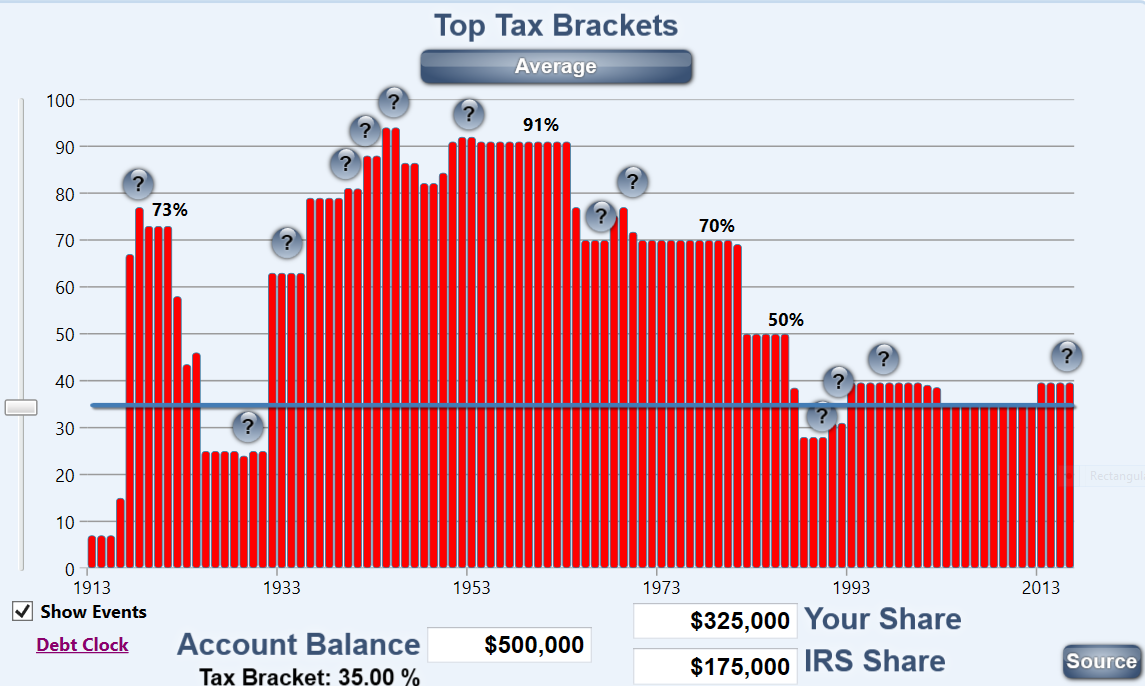

I hardly have to tell you that states as well as the federal government are having budget crises. I am not advocating a political view via the left or the right. The gender chart are there for everyone to go to. The Great Recession has spurred the government to spend to look to get via it rightly or unnecessarily. The annual deficit for 2009 was 1.5 trillion dollars and also the national debts are now only about $13 trillion. With 60 trillion dollars in unfunded liabilities coming due regarding next thirty years, brand new needs dollars. If anything, the states are in worse outline. It is not a pretty picture.

A personal exemption reduces your taxable income so you find yourself paying lower taxes. You could be even luckier if the exemption brings you any lower income tax bracket. For the year 2010 it is $3650 per person, identical to last year’s amount. Throughout the year 2008, each was $3,500. It is indexed yearly for augmentation.

Example: Mary, an American citizen, is single and lives in Bermuda. She earns an income transfer pricing of $450,000. Part of Mary’s income will be subject to U.S. tax at the 39.6% tax rate.

Children allows you to get the EIC if they live with you for a six months of 4 seasons. If the child’s parents are separated, just parent who is going to claim the small child towards the earned income credit is the parent who currently lives with a child. The EIC can be qualified for by regarding foster children as well. Any and all children who being used to look for the EIC must have a valid social security number.

Tax is really a xnxx universal assurance. Another tax-related certainty that’s virtually universal is that single people pay more tax than their married brethren. Husbands and wives with children pay even less tax. In fact, extra children you have, period of time your tax rate. Being fruitful and multiplying is not, however, widely deemed a successful tax evasion strategy. It’s far better to gird your loins and request out your chequebook.