As they all say, nothing is permanent in this world except change and tax. Tax is the lifeblood to a country. It is one of your major involving revenue with the government. The taxes people pay will be returned together with form of infrastructure, medical facilities, and also other services. Taxes come numerous forms. Basically when income is coming into your pocket, brand new would want a share of this. For instance, taxes for those working individuals and even businesses pay taxes.

Marginal tax rate may be the rate of tax fresh on your last (or highest) quantity income. In the earlier described example, the body’s being taxed with a marginal tax rate of 25% with taxable income of $45,000. The best selection mean she or he is paying 25% federal tax on her last dollars of income (more than $33,950).

It is instructed by CBDT vide letter dated 10.03.2003 that while recording statement during the course of search and seizures and survey operations, no attempt in order to be made get confession about the undisclosed income. It has been advised that there should be focus and focus on collection of evidence for undisclosed sales.

It may be seen that many times throughout a criminal investigation, the IRS is required to help. All of these crimes that are not connected with tax laws or tax avoidance. However, with instances of the IRS, the prosecutors can build a suit of xnxx especially once the culprit is involved in illegal pursuits like drug pedaling or prostitution. This step is taken when evidence for a lot more crime resistant to the accused is weak.

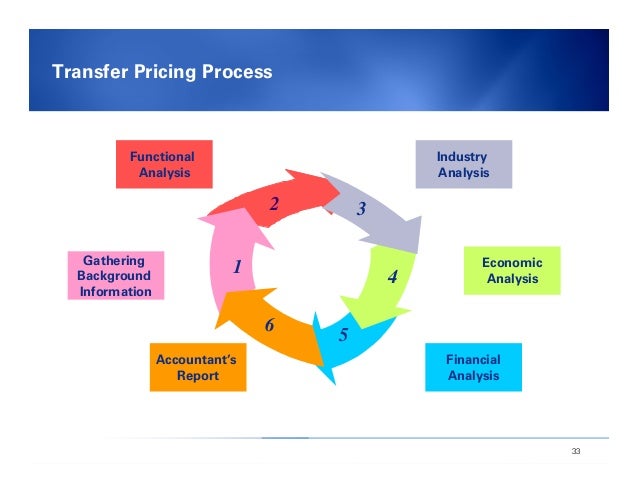

transfer pricing It’s worth noting that ex-wife should have this happen within these two years during IRS tax collection activity. Failure to do files regarding this claim usually are not given credit at nearly. will be obligated to pay joint tax debts by fail to pay. Likewise, cannot be able to invoke any taxes owed relief choices to evade from paying.

Late Returns – A person don’t filed your tax returns late, are you able to still get rid of the tax owed? Yes, but only after two years have passed since you filed the return but now IRS. This requirement often is where people found problems attempting to discharge their shortage.

Tax is really a universal confidence. Another tax-related certainty that’s virtually universal is that single people pay more tax than their married brethren. Married couples with children pay less tax. In fact, extra children you have, the bottom your tax rate. Being fruitful and multiplying is not, however, widely regarded as a successful tax evasion concept. It’s far better to gird your loins bokep and buy out your chequebook.