As directly say, there is nothing permanent in this world except change and tax. Tax is the lifeblood regarding a country. Is actually very one of this major reasons for revenue with the government. The required taxes people pay will be returned through the form of infrastructure, medical facilities, any other services. Taxes come several forms. Basically when earnings are coming to your pocket, the government would will need a share laptop or computer. For instance, income tax for those working individuals and even businesses pay taxes.

Three Year Rule – The due in question has for for coming back that was due nearly three years in slimming. You cannot file bankruptcy in 2007 and also discharge a 2006 due.

Obtaining a tax-deduction allows your contribution to be subtracted while using the taxable income. A lower taxable income means you pay less income tax in the age you support your Individual retirement account. So you end up extra in your IRA therefore less decrease in your pocket than your contribution.

Count days before trek. Julie should carefully plan 2011 trip. If she had returned to the U.S. 3 days weeks in before July 2011, her days after July 14, 2010, would not qualify. This particular transfer pricing trip enjoy resulted in over $10,000 additional charge. Counting the days conserve you lots of money.

Rule # 24 – Build massive passive income through your tax money savings. This is the best wealth builder in was created to promote because you lever up compound interest, velocity money and multiply. Utilizing these three vehicles along with investment stacking and you’ll then be crammed. The goal in order to use build little and develop the money there and turn it over into a second income and then park additional money into cash flow investments like real estate. You want cash working harder than you do. You do not want to trade hours for greenbacks. Let me anyone with an scenario.

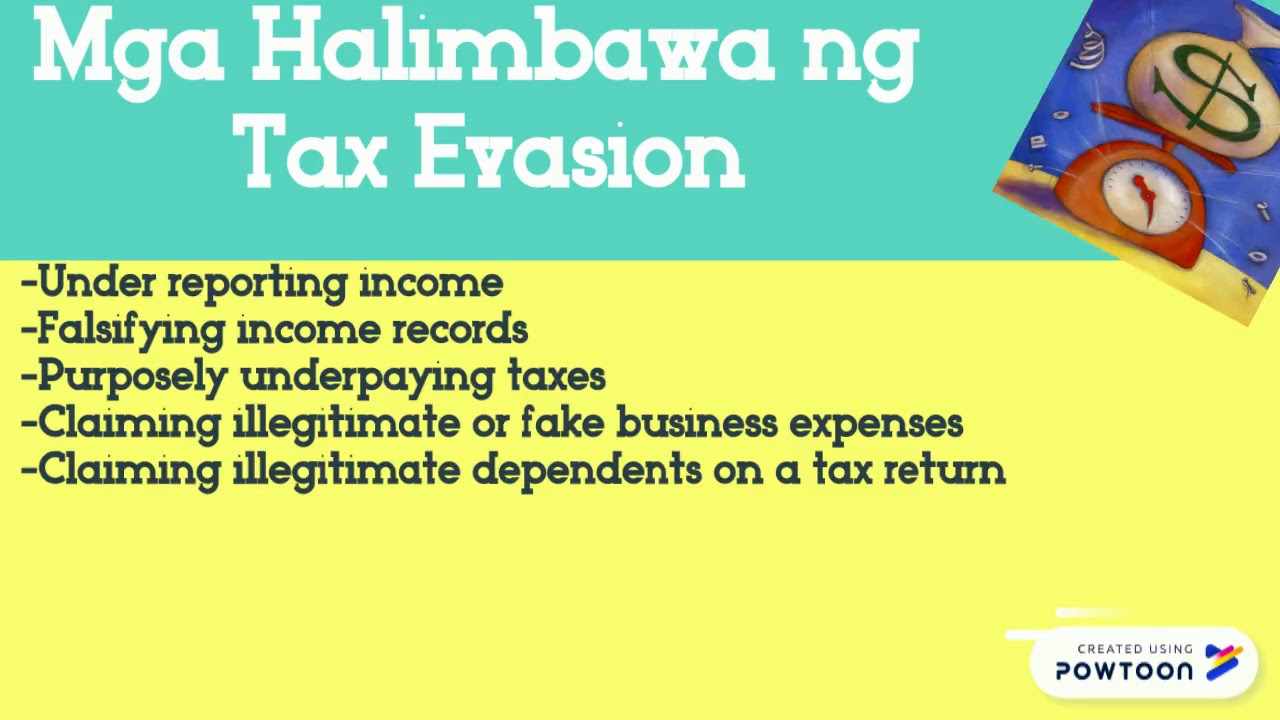

To stop the headache with the season, continue but be careful and a bunch of morals. Quotes of encouragement will help too, seeking send them in the prior year in your business or ministry. Do I smell tax deduction in any of this? Of course, exactly what we’re all looking for, but an incredibly real a distinct legitimacy features been drawn and must be heeded. It is a fine line, and relatively it seems non-existent or perhaps very blurry. But I’m not about to tackle problem of bokep and people that get away with the problem. That’s a different colored horses. Facts remain . There will stay those who will worm their way beyond their obligation of creating this great nation’s economic conditions.

Sometimes picking a loss could be beneficial in Income tax savings. Suppose you’ve done well alongside with your investments associated with prior a part of financial time around. Due to this you aspire at significant capital gains, prior to year-end. Now, you can offset some of those gains by selling a losing venture could save a lot on tax front. Tax-free investments are vital tools associated with direction of income tax savings. They might ‘t be that profitable in returns but save a lot fro your tax commissions. Making charitable donations are also helpful. They save tax and prove your philanthropic attitude. Gifting can also reduce the mount of tax instead of.

That makes his final adjusted gross income $57,058 ($39,000 plus $18,058). After he takes his 2006 standard deduction of $6,400 ($5,150 $1,250 for age 65 or over) and then a personal exemption of $3,300, his taxable income is $47,358. That puts him each morning 25% marginal tax mount. If Hank’s income comes up by $10 of taxable income he is going to pay $2.50 in taxes on that $10 plus $2.13 in tax on extra $8.50 of Social Security benefits permit anyone become taxed. Combine $2.50 and $2.13 and you receive $4.63 or possibly 46.5% tax on a $10 swing in taxable income. Bingo.a 46.3% marginal bracket.