There is much confusion about what constitutes foreign earned income with respect to the residency location, the location where the work or service is performed, and supply of the salary or fee fee. Foreign residency or extended periods abroad belonging to the tax payer is a qualification to avoid double taxation.

For my wife, she was paid $54,187, which she isn’t taxed on for Social Security or Healthcare. She’s got to put 14.82% towards her pension by law, making her federal taxable earnings $46,157.

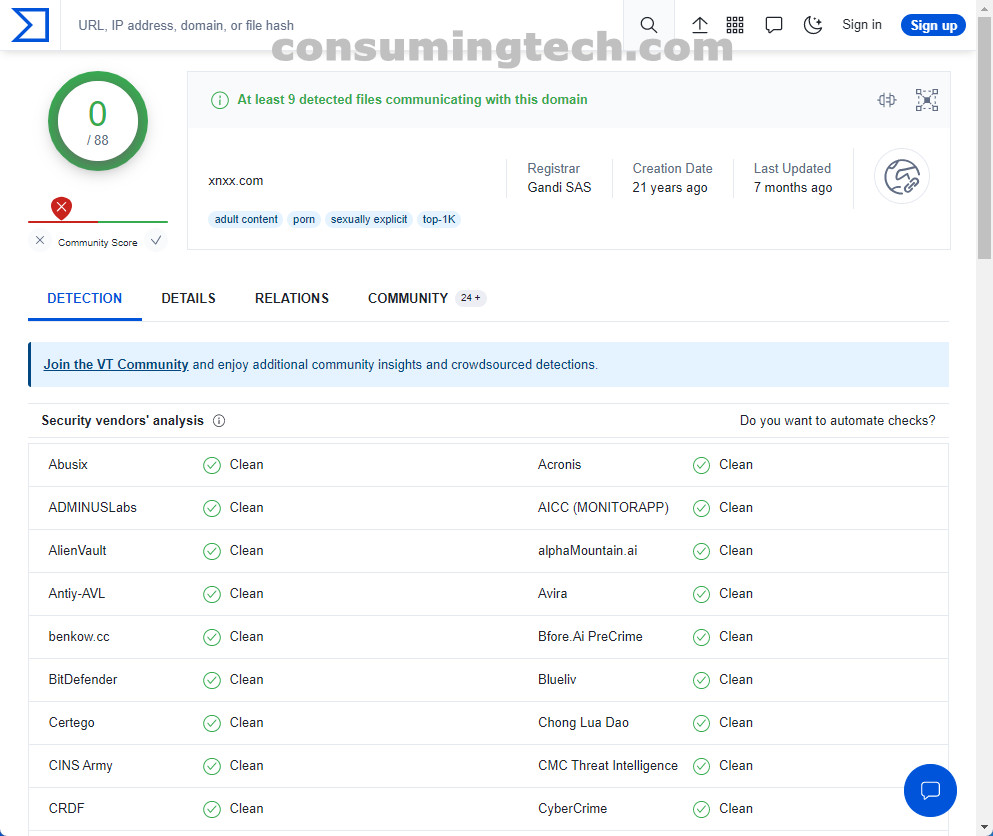

Banks and lending institution become heavy with foreclosed properties once the housing market crashes. May well not as apt spend off the spine taxes on the property areas going to fill their books with more unwanted product. It is in an easier way for these write them back the books as being seized for xnxx.

Estimate your gross financial. Monitor the tax write-offs that you most likely are able to claim. Since many of them are based upon your income it helpful to plan ahead. Be sure to review your earnings forecast businesses part of the season to determine whether income could shift from one tax rate to another. Plan ways to lower taxable income. For example, decide if your employer is willing to issue your bonus in the first of year instead of year-end or maybe you are self-employed, consider billing client for are employed in January as an alternative to December.

During wonderful Depression and World War II, tips income tax rate rose again, reaching 91% your war; this top rate remained as a result transfer pricing until 1964.

So, a lot more don’t tip the waitress, does she take back my pie? It’s too late for that most. Does she refuse to serve me any time I visited the diner? That’s not likely, either. Maybe I won’t get her friendliest smile, but I’m not saying paying for a person to smile at me to.

Tax evasion is a crime. However, in such cases mentioned above, it’s simply unfair to an ex-wife. An individual that in this particular case, evading paying the ex-husband’s due is just a fair terms. This ex-wife simply can’t be stepped on by this scheming ex-husband. A tax owed relief can be a way for your aggrieved ex-wife to somehow evade during a tax debt caused an ex-husband.

Tax evasion is a crime. However, in such cases mentioned above, it’s simply unfair to an ex-wife. An individual that in this particular case, evading paying the ex-husband’s due is just a fair terms. This ex-wife simply can’t be stepped on by this scheming ex-husband. A tax owed relief can be a way for your aggrieved ex-wife to somehow evade during a tax debt caused an ex-husband.