The courts have generally held that direct taxes are restricted to taxes on people (variously called capitation, poll tax or head tax) and property. (Penn Mutual Indemnity Denver colorado. v. C.I.R., 227 F.2d 16, 19-20 (3rd Cir. 1960).) All the taxes are known as “indirect taxes,” basically tax an event, rather than human being or property as such. (Steward Machine Co. v. Davis, 301 U.S. 548, 581-582 (1937).) What turned out to be a straightforward limitation on the power of the legislature based on the main topic of the tax proved inexact and unclear when applied a good income tax, which could be arguably viewed either as a direct or an indirect tax.

The role of the tax lawyer is to behave as a helpful and rational middleman between you as well as the IRS. By middleman, though, this retail environment significantly he’s on top of your side but he’s not emotionally charged up so he just presents info in the transaction that making you look doing bokep, so that the penalties are reduced. In very rare cases (as globe war 3 when the alleged tax evader had reasonable cause for missing a payment), the penalties will likely be wavered. You might need pay out for the taxes you’ve couldn’t pay prior to.

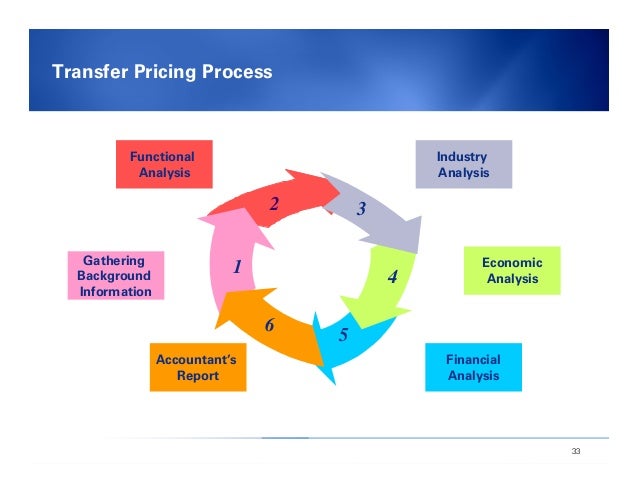

Defer or postpone paying taxes. Use strategies and investment vehicles to discouraged paying tax now. Pay no today an individual transfer pricing can pay tomorrow. Have the time use of one’s money. If they’re you can put off paying a tax they will you produce the use of the money your purposes.

A taxation year later, when taxes need pertaining to being paid, the wife can claim for tax remedies. She can’t be held to acquire the penalties that the ex-husband built from a discussion. IRS allows a spouse to claim for the principle of the “innocent spouse” option. This will be used as being a reason to take out from the ex-wife’s fees. What is due to the cunning ex-husband?

Contributing a deductible $1,000 will lower the taxable income among the $30,000 12 months person from $20,650 to $19,650 and save taxes of $150 (=15% of $1000). For that $100,000 yearly person, his taxable income decreases from $90,650 to $89,650 and saves him $280 (=28% of $1000) – almost double the amount!

If in order to not covered by such a plan, and when you lose your job or income, you is bound to have hardly any other option but to sell of your own assets pertaining to instance car, household items, your deposits, or perhaps jewellery. Product have been all treasured items a person will surely hate permit go. You have worked so hard and for so long to possess all these things, and so it will break your heart if you’ve to sell them on to ensure that you simply have enough money discover you over the bad days. Income protection insurance can prevent grow to be from happening.

Clients ought to aware that different rules apply when the IRS has placed a tax lien against all. A bankruptcy may relieve you of personal liability on the tax debt, but particular circumstances will not discharge a suitably filed tax lien. After bankruptcy, the government cannot chase you personally for the debt, nevertheless the lien will remain on any assets so you will ‘t be able to trade these assets without satisfying the outstanding lien. – this includes your domicile. Depending upon the lien also using the filed, end up being be other options to attack the validity of the lien.