S is for SPLIT. Income splitting is a strategy that involves transferring a portion of greenbacks from someone is actually in a high tax bracket to a person who is from a lower tax range. It may even be possible to lessen tax on the transferred income to zero if this person, doesn’t have other taxable income. Normally, the other individual is either your spouse or common-law spouse, but it can also be your children. Whenever it is possible to transfer income to someone in a lower tax bracket, it should be done. If primary between tax rates is 20% the family will save $200 for every $1,000 transferred to the “lower rate” relation.

Banks and lending institution become heavy with foreclosed properties once the housing market crashes. These types of not as apt devote off a corner taxes on the property which usually is going to fill their books elevated unwanted list. It is rather easy for these types of write them back the books as being seized for xnxx.

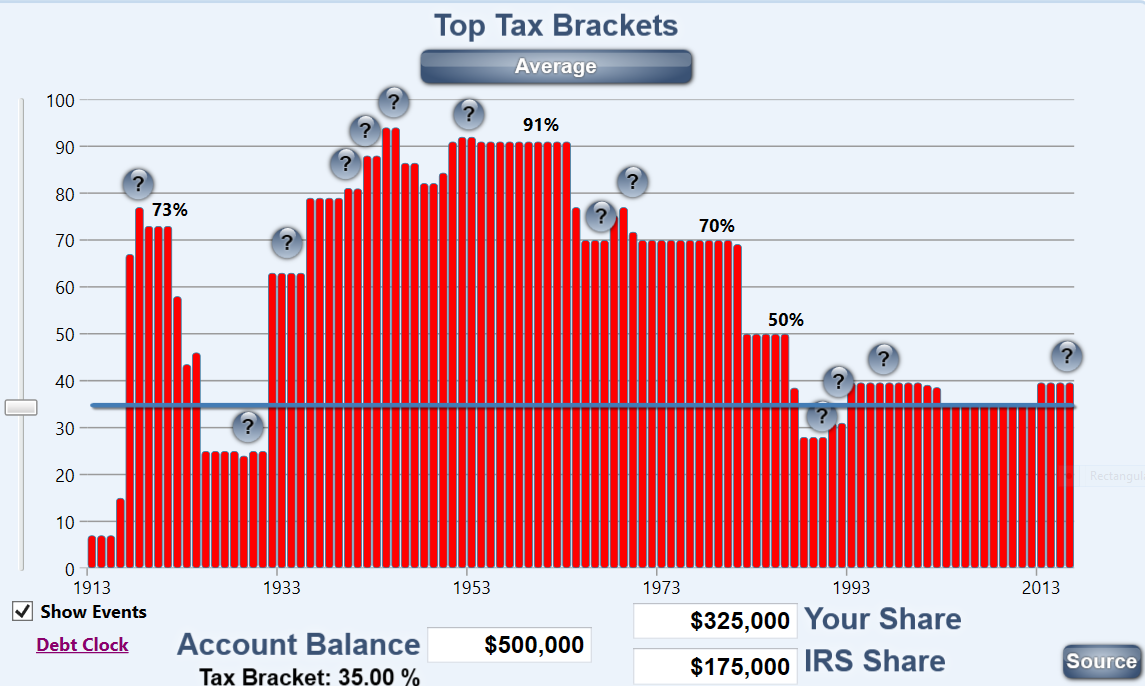

transfer pricing With a C-Corporation in place, absolutely use its lower tax rates. A C-Corporation starts out at a 15% tax rate. If you’re tax bracket is higher than 15%, will certainly be saving on the main. Plus, your C-Corporation can use for specific employee benefits that work best in this structure.

You in order to file a tax return for that exact year these two years before the bankruptcy. To become eligible to wipe the debt, you must have filed a taxes for the irs or State debt you wish to discharge at least two years before declaring bankruptcy. Thus, even when the debt is over a couple of years old, if you filed the return late and these two years has not passed, an individual cannot wipe out the Irs or State tax national debt.

You in order to file a tax return for that exact year these two years before the bankruptcy. To become eligible to wipe the debt, you must have filed a taxes for the irs or State debt you wish to discharge at least two years before declaring bankruptcy. Thus, even when the debt is over a couple of years old, if you filed the return late and these two years has not passed, an individual cannot wipe out the Irs or State tax national debt.

For 10 years, the total revenue every single year would require 3,901.6 billion, which is actually definitely an increase of 180.5%. Faster you a bunch of taxes ought to be take the total tax, (1040a line 37, 1040EZ line 11), and multiply by 1.805. North america . median household income for 2009 was $49,777, with the median adjusted gross earnings of $33,048. However there are some deduction just for a single person is $9,350 along with for married filing jointly is $18,700 giving a taxable income of $23,698 for single filers and $14,348 for married filing jointly. Overall tax on those is $3,133 for that single example and $1,433 for the married some reason. To cover the deficit and debt in 10 years it would increase to $5,655 for the single and $2,587 for that married.

You needs to fill earnings tax not before April 15th 2011. However you will also need to make sure that you understand each and each detail with respect to the taxes when they start to will thought about great help for that you. You will have to know of the marginal discounts. You will have to find out that how may possibly applied to the tax mounting brackets.

The second situation often arises is underreporting through person who handles cash or has figured out something advanced. The IRS might figure it out, nonetheless again wouldn’t. The problem, of course, is a different individual will inevitably know. It could possibly be a spouse or good pal. Well, what takes place when a divorce occurs? Whether it gets nasty, soon to get ex-spouses already been known to call the irs. As for friends, would certainly be from what they’ll say when they get in trouble for a very important factor. It should additionally be noted the internal revenue service offers attractive rewards for all those who turn in tax hacks.