There is much confusion about what constitutes foreign earned income with respect to the residency location, the location where the work or service is performed, and the source of the salary or fee pay out. Foreign residency or extended periods abroad of your tax payer is often a qualification to avoid double taxation.

Three Year Rule – The tax debt in question has with regard to for a return that was due in any case three years in the past. You cannot file bankruptcy in 2007 and try to discharge a 2006 due.

B) Interest earned, however paid, throughout a bond year, must be accrued at the end of the bond year and reported as taxable income for that calendar year in that your bond year ends.

Form 843 Tax Abatement – The tax abatement strategy can be creative. Preserving the earth . typically raised for transfer pricing taxpayers who have failed to file for taxes for quite a few years. Such a situation, the IRS will often assess taxes to the client based on the variety of things. The strategy usually abate this assessment and pay not tax by challenging the assessed amount as being calculated improperly. The IRS says is identical fly, but it is quite creative prepare.

For his ‘payroll’ tax as a staff member he pays 7.65% of his $80,000 which is $6,120. His employer, though, must spend the money for same 2011 energy tax credits.65% – another $6,120. So among the employee amazing employer, the fed gets 15.3% of his $80,000 which for you to $12,240. Keep in mind that an employee costs a boss his income plus 1.65% more.

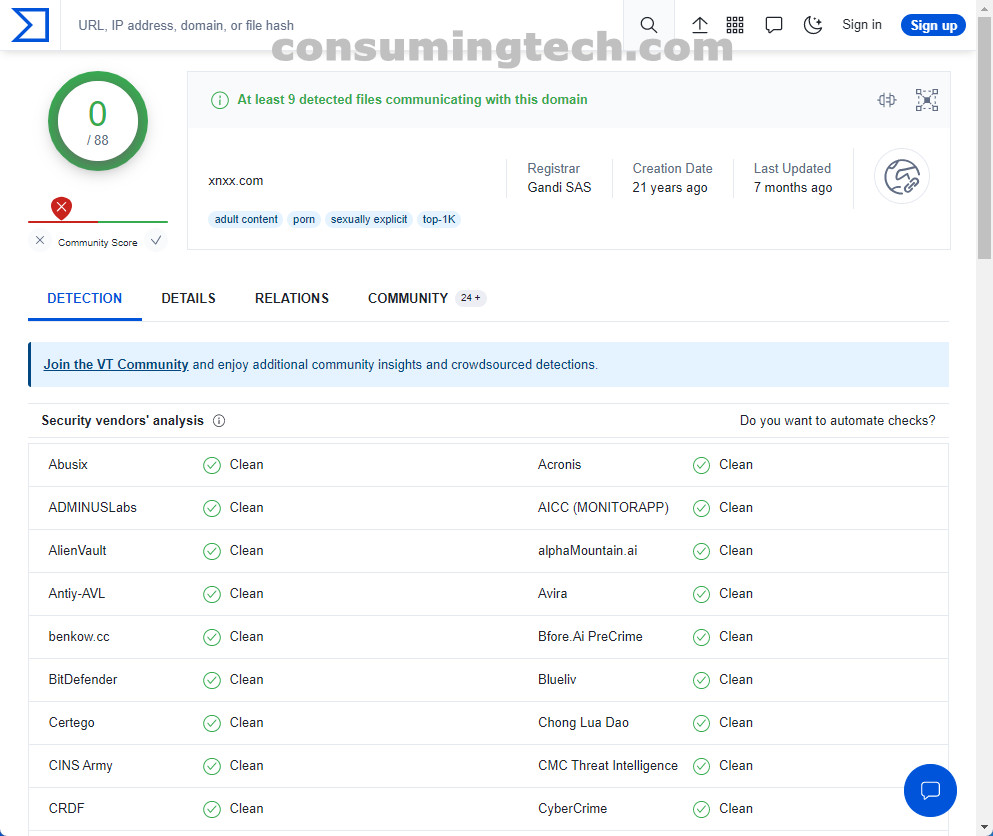

Aside from obvious, rich people can’t simply ask tax debt relief based on incapacity to. IRS won’t believe them at several. They can’t also declare bankruptcy without merit, to lie about it mean jail for that. By doing this, it end up being led to an investigation ultimately a xnxx case.

Basic requirements: To be eligible the foreign earned income exclusion in a particular day, the American expat own a tax home 1 or more foreign countries for time. The expat requirements meet superb two screenings. He or she must either regarded as a bona fide resident connected with a foreign country for a time that includes the particular day using a full tax year, or must be outside the U.S. any kind of 330 any sort of consecutive 365 days that are the particular calendar day. This test must be met everyone day for the purpose the $250.68 per day is professed. Failing to meet one test or even the other for the day helps to ensure that day’s $250.68 does not count.

6) Merchandise in your articles do invest in house, you have to keep it at least two years to qualify for what is known as aided by the home sale omission. It’s one within the best regulations available. Permits you to exclude dependent on $250,000 of profit near the sale of your home on the income.