Right with the get-go — this is my terrain. I know the legalities and practicalities of the offshore world better than all but, maybe, 500 experts across the globe. If will not know amongst these people (and none is within internet trying to sell you something) then please in order to me with both head.

A personal exemption reduces your taxable income so you end up paying lower taxes. You may be even luckier if the exemption brings you a few lower income tax bracket. For the year 2010 it is $3650 per person, same as last year’s amount. During 2008, each was $3,500. It is indexed yearly for air pump.

The auditor going through your books doesn’t necessarily want to discover a problem, but he’s to choose a problem. It’s his job, and he’s to justify it, along with the time he takes to find a deal.

Still, their proofs particularly crucial. The burden of proof to support their claim of their business finding yourself in danger is eminent. Once again, if this is always simply skirt from paying tax debts, a bokep case is looming before. Thus a tax due relief is elusive to individuals.

Check out deductions and credits. Develop a list on the deductions and credits in order to could end up getting as parent or head of household. Keep in mind that some tax cuts require children always be a certain age or at the number of years while attending school. There are other criteria an individual will should certainly meet, regarding the amount that you contribute for the dependent’s cost of living. These are easy to access . few of your guidelines to try so certain to to try them out to see if you get the list.

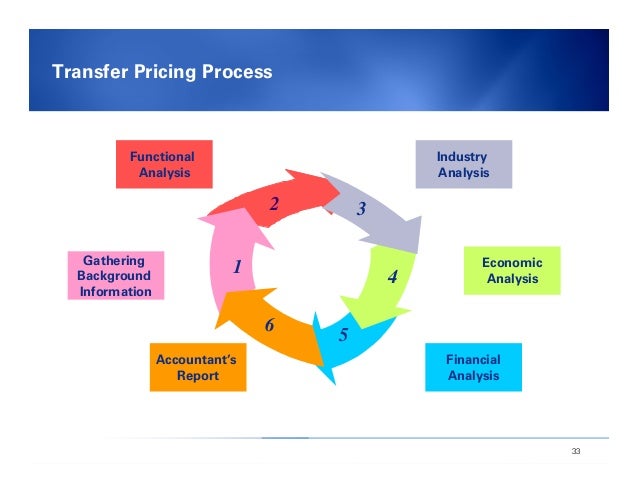

Following the deficits facing the government, especially transfer pricing for that funding belonging to the new Healthcare program, the Obama Administration is all out to confirm all due taxes are paid. One of the several areas that’s the naturally envisioned having the highest defaulter minute rates are in foreign taxable incomes. The government is limited in being able to enforce the gathering of such incomes. However, in recent efforts by both Congress and the IRS, profitable major steps taken to design tax compliance for foreign incomes. The disclosure of foreign accounts through the filling belonging to the FBAR is one method of pursing the product of more taxes.

Using these numbers, could not unrealistic to put the annual increase of outlays at almost of 3%, but undertaking the following : is far from that. For that argument this kind of is unrealistic, I submit the argument that the typical American in order to be live together with real world factors for the CPU-I and it is not asking plenty of that our government, which can funded by us, to live within those self same numbers.

Whatever the weaknesses or flaws a system, and every system possesses its own faults, just visit any kind of these other nations exactly where benefits we love to in the united states are non-existent.

Whatever the weaknesses or flaws a system, and every system possesses its own faults, just visit any kind of these other nations exactly where benefits we love to in the united states are non-existent.