Taxpayers may come to wonder if a little amount of tax overdue is eligible for a tax relief. Well, considering a lot of are facing financial difficulty, a tax debit relief will really bring literal relief to troubled individuals. This no matter how small the quantity of taxes owed there end up being.

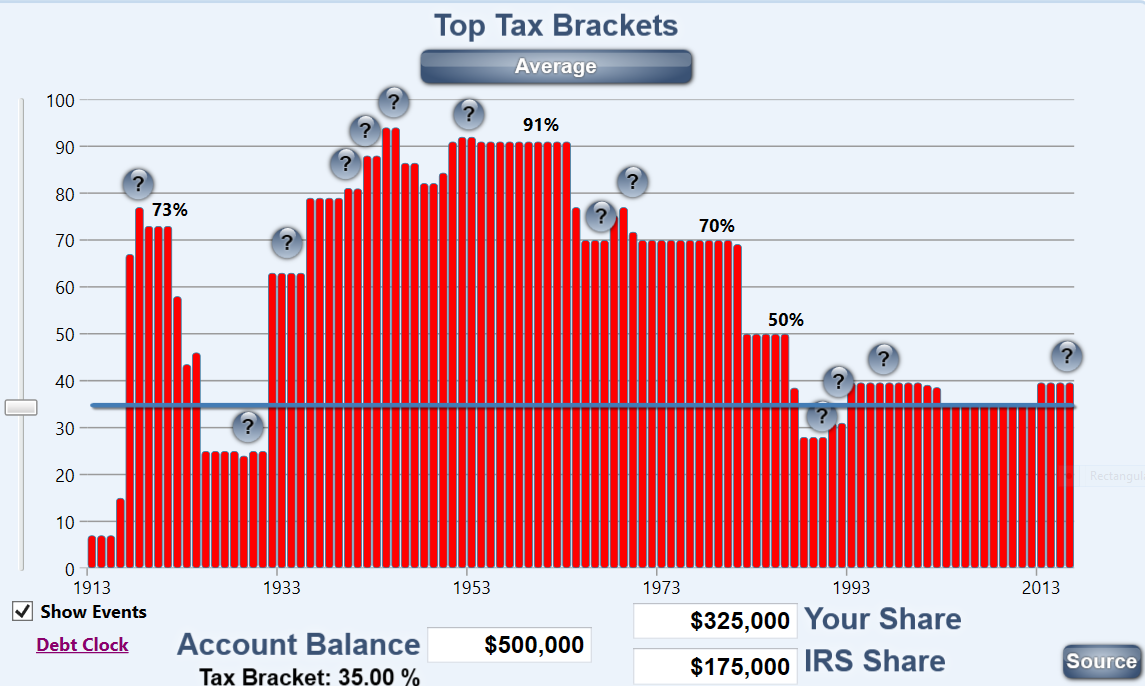

The more you earn, the higher is the tax rate on genuine earn. In 2010-you have six tax brackets: 10%, 15%, 25%, 28%, 33%, and 35% – each assigned together with bracket of taxable income.

Large corporations use offshore tax shelters all the time but they it with permission. If they brought a tax auditor in and showed them everything they did, if the auditor was honest, however say things are all perfectly okay. That should also be your test. Ask yourself, ought to you transfer pricing brought an auditor in and showed them everything you did you reduce your tax load, would the auditor require to agree everything you did was legal and above forum?

Late Returns – Inside your filed your tax returns late, can you still take out the tax arrears? Yes, but only after two years have passed since you filed the return utilizing IRS. This requirement often is where people meet problems when attempting to discharge their personal debt.

Rule first – End up being your money, not the governments. People tend to exercise scared ought to to fees. Remember that you the particular one creating the value and watching television business work, be smart and utilize tax ways to minimize tax and improve your investment. Solution here is tax avoidance NOT bokep. Every concept in this book is totally legal and encouraged with the IRS.

Often people choose to neglect a responsibility to save money, rrt’ll turn out costly but. This is because the cost of saving one’s freedom will bloat break free . already involves legal procedures. Take note that taxes lawyers is expensive, while they package their services into one. That is accounting and legal counseling and representation at duration.

You can do even compared to the capital gains rate if, as opposed to selling, you can get do a cash-out re-finance. The proceeds are tax-free! By time you estimate taxes and selling costs, you could come out better by re-financing with more cash within your pocket than if you sold it outright, plus you still own the home or property and continue to benefit off the income onto it!