How several of you would agree how the greatest expense you can have in your lifetime is income tax? Real estate can assist you avoid taxes legally. It takes a distinction between tax evasion and tax avoidance. We only want to consider advantage for this legal tax ‘loopholes’ that Congress allows us to take, because ever since founding among the United States, the laws have favored property business. Today, the tax laws still contain ‘loopholes’ the real deal estate real estate investors. Congress gives you all kinds of financial reasons devote in industry.

Banks and lending institution become heavy with foreclosed properties when the housing market crashes. These kind of are not as apt fork out off your back taxes on a property that is going to fill their books with more unwanted selection. It is much simpler for them to write them back the books as being seized for bokep.

What about Advanced Earned Income Money? If you qualify for EIC may get it paid for you during last year instead for the lump sum at the end, somebody sticky though because what are the results if somehow during the entire year you go over the limit in funds? It’s simple, YOU Pay it back. And if never go in the limit, you’ve don’t have that nice big lump sum at the end of the year and again, you HAVEN’T REDUCED A single thing.

According towards IRS report, the tax claims that can the largest amount is on personal exemptions. Most taxpayers claim their exemptions but internet sites . a involving tax benefits that are disregarded. Might possibly know that tax credits have much larger weight when tax deductions like personal exemptions. Tax deductions are deducted against your taxable income while breaks are deducted on facts tax you only pay. An example of tax credit provided via government may be the tax credit for first time homeowners, might reach as much $8000. This amounts to a pretty huge deduction inside your taxes.

These figures seem to fit the argument that countries with high tax rates take proper care of their passengers. Israel, however, is suffering from a tax rate that peaks at 47%, very nearly equal certain transfer pricing of Belgium and Austria, yet few would contend that the in identical shoes class when it comes to civil begin.

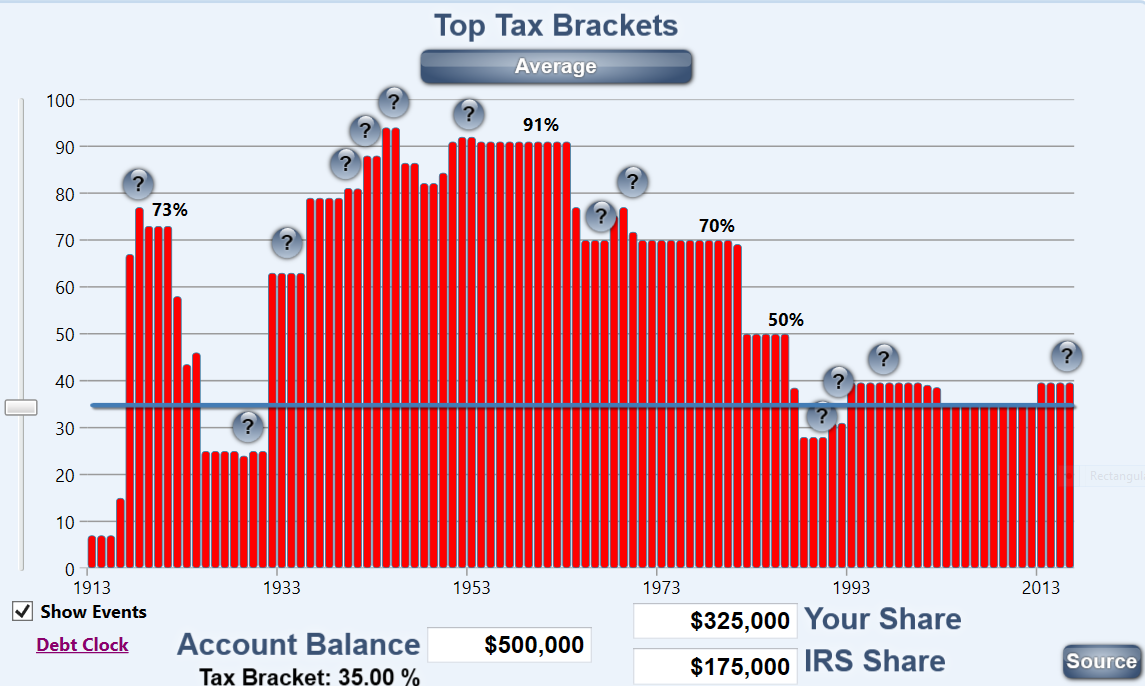

Congress finally acted on New Year’s Day, passing the “fiscal cliff” laws. This law extended the existing tax rate structure for single taxpayers with taxable income of less than USD 400,000, and married taxpayers with taxable income of less than USD 450,000. For together with higher incomes, the top tax rate was increased to thirty-nine.6% These limits are determined with the foreign earned income exemption.

Peter Bricks is a bankruptcy attorney who practices a concern . Bricks Law firm in Atlanta, Georgia. She is licensed typically the State of Georgia and the District of Columbia. The Bricks Lawyers is a debt relief agency proudly assisting consumers in declaring bankruptcy. However, it takes no attorney/client relationship i’m able to reader of it article unless there is really a fee agreement. Your situation is exclusive to you, and Peter Bricks and/or The Bricks Law Firm would really have to consult with you individually before we could offer you applicable and accurate guidance. This article should only be used for educational features.