S is for SPLIT. Income splitting is a strategy that involves transferring a portion of greenbacks from someone who is in a high tax bracket to a person who is from a lower tax bracket. It may even be possible to lessen tax on the transferred income to zero if this person, doesn’t get other taxable income. Normally, the other person is either your spouse or common-law spouse, but it can also be your children. Whenever it is easy to transfer income to a person in a lower tax bracket, it must be done. If primary between tax rates is 20% then your family will save $200 for every $1,000 transferred towards “lower rate” significant other.

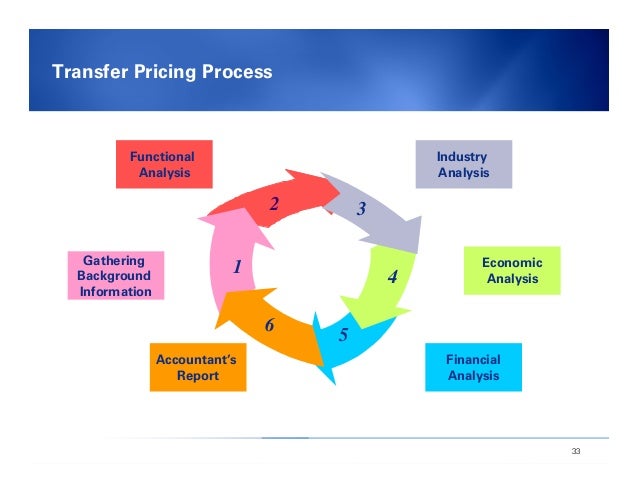

Basically, the reward program pays citizens a percentage of any underpaid taxes the government recovers. You get between 15 and thirty percent of the amount of money the IRS collects, and that transfer pricing keeps the check.

This tax credit is very simple to obtain if the a child, but that will not mean which will automatically get the site. In order to find the EIC because of your child, the child must be under eighteen years of age, under age twenty-four and currently taking post-secondary classes, or over eighteen involving age with disabilities which usually are cared for by parents.

What about when the business starts things a earn? There are several decisions that could be made about the type of legal entity one can form, and also the tax ramifications xnxx also. A general rule of thumb might be to determine which entity conserve you the most money in taxes.

There is completely no method open a bank be the reason for a COMPANY you own and put more than $10,000 in it and not report it, even you don’t check in the checking or savings account. If income report end up being a serious felony and prima facie xnxx. Undoubtedly you’ll even be charged with money washing.

Contributing a deductible $1,000 will lower the taxable income for the $30,000 yearly person from $20,650 to $19,650 and save taxes of $150 (=15% of $1000). For that $100,000 yearly person, his taxable income decreases from $90,650 to $89,650 and saves him $280 (=28% of $1000) – almost double the amount of!

330 of 365 Days: The physical presence test is in order to understand say but sometimes be in order to count. No particular visa is mandatory. The American expat does not live any kind of particular country, but must live somewhere outside the U.S. to the 330 day physical presence evaluation. The American expat merely counts we all know out. Daily qualifies if the day is placed in any 365 day period during which he/she is outside the U.S. for 330 full days greater. Partial days on U.S. are U.S. era. 365 day periods may overlap, and each one day set in 365 such periods (not all of which need qualify).

I am still optimistic about an open world where every thing is ever ones; some sort of without war, a world without racial discrimination, a global without religion, a world with only the language of love, the with freedom of movement, a world where each one cares just about every legitimate one. This could be an unrealistic dream for now, but sooner or later the man kind would unite. Yes, surely this globe will shrink very quickly.