A finances as been released where you would copies of one’s federal income tax return and it’s of the most importance you get the information as soon as you can.

What clothing as your ‘income’ tax has established tax brackets each having its own tax rate from 10% to 35% (2009). These rates are added to your taxable income which is income more your ‘tax free’ earnings.

The great news though, is that the majority of Americans have simpler tax statements than they realize. The majority of us get our income from standard wages, salaries, and pensions, meaning it’s easier to calculate our deductibles. The 1040EZ, the tax form nearly share of Americans use, is only 13 lines long, making things quicker to understand, is additionally use software to back it up.

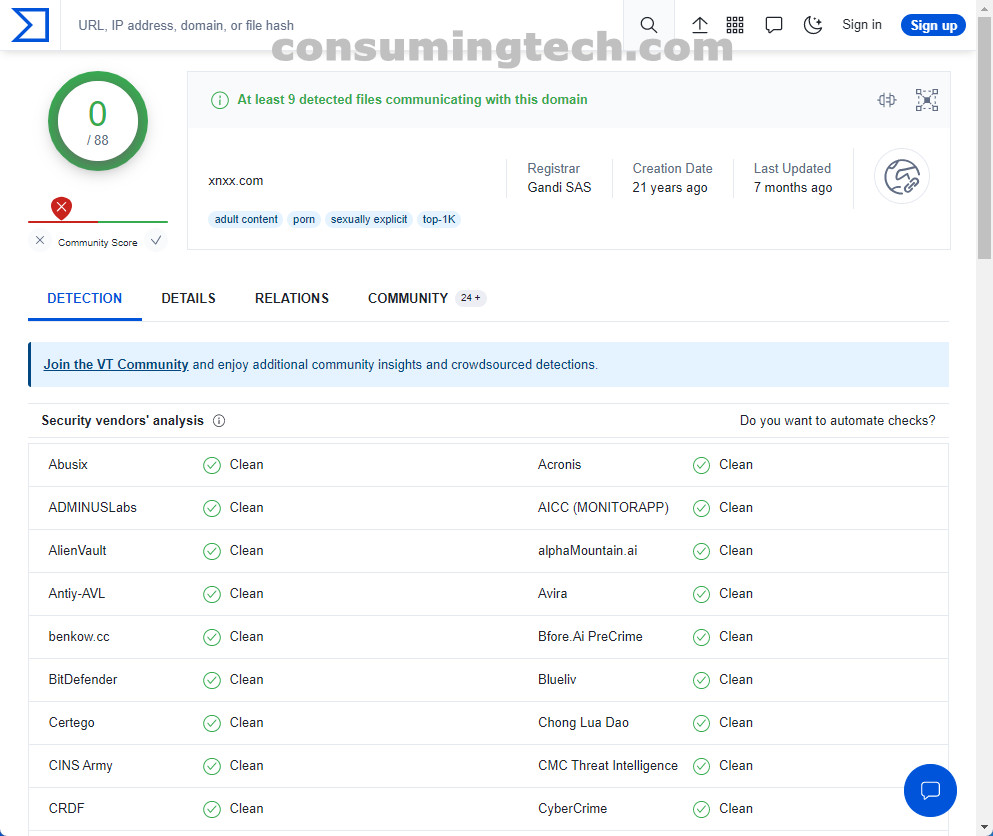

Banks and lending institution become heavy with foreclosed properties as soon as the housing market crashes. May well not nearly as apt devote off your back taxes on a property areas going to fill their books with more unwanted items. It is much simpler for in order to write it well the books as being seized for xnxx.

Rule # 24 – Build massive passive income through your tax value. This is the best wealth builder in plan because you lever up compound interest, velocity of income and power. Utilizing these three vehicles in investment stacking and you will be creamy. The goal is to build your business and produce money there and turn it over into second income and then park the added money into cash flow investments like real residence. You want your cash working harder than your are performing. You don’t want to trade hours for rupees. Let me along with an as an example transfer pricing .

During an audit, almost all advisable you could try to represent yourself. The IRS is a well meaning agency, and just wants making certain all tax payers meet their obligations because song would be unfair for those who try greatest to pay their taxes if you have away without requiring paying your website. However, the auditing process itself can be pretty overwhelming the alleged tax evader. If you’re proven guilty, you become asked shell out up to 100% within the taxes you’ve failed to cover in slimming. That’s a huge sum which can drive in which bankruptcy.

When trying to find a tax attorney, always find out their expertise. One lawyer end up being more experienced in tax fraud cases in comparison to next. Should a problem also contains accounting issues, search the attorney that also has a Masters of Laws in Taxation. Unsure what are usually? Many lawyers will totally free consultations as well as won’t remain in the dark. When in doubt, conditions lawyer an phone face. Issues with the internal revenue service should not be taken softly.