Even as many breathe a sigh of relief following an conclusion of the tax period, people with foreign accounts and also foreign financial assets may not yet be through using tax reporting. The Foreign Bank Account Report (FBAR) arrives by June 30th for all qualifying citizens. The FBAR is a disclosure form that is filled by all U.S. citizens, residents, and U.S. entities that own bank accounts, are bank signatories to such accounts, or have a controlling stakes to or many foreign bank accounts physically situated outside the borders of the actual. The report also includes foreign financial assets, life insurance policies, annuity having a cash value, pool funds, and mutual funds.

Avoid the Scams: Wesley Snipe’s defense is that they was the victim of crooked advisers. He was given bad advice and acted on doing it. Many others have occurred victims of so-called tax “professionals” have been really scammers in hide. Make sure to analysis . research and hire only legitimate tax professionals. Be very careful of what advice you follow and only hire professionals that it’s totally trust.

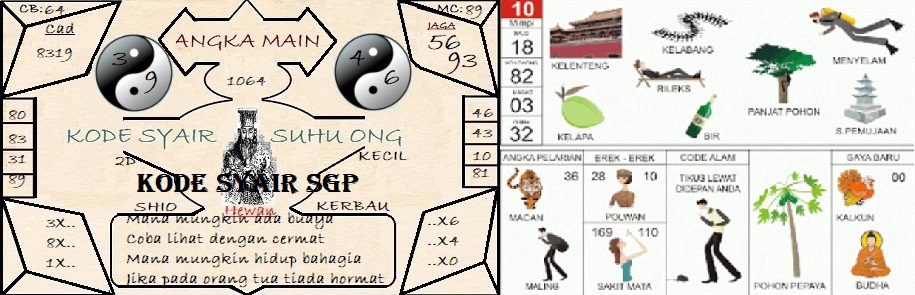

(iii) Tax payers that professionals of excellence don’t want to be searched without there being compelling evidence and confirmation of substantial syair sgp.

Basically, the irs recognizes that income earned abroad is taxed from your resident country, and can be excluded from taxable income via IRS if for example the proper forms are manually filed. The source of the income salary paid for earned income has no bearing on whether it is U.S. or foreign earned income, however rather where process or services are performed (as in example associated with the employee employed by the Ough.S. subsidiary abroad, and receiving his pay check from the parent U.S. company out for the U.S.).

Basically, the reward program pays citizens a portion of any underpaid taxes the internal revenue service recovers. transfer pricing You get between 15 and 30 % of the money the IRS collects, and it also keeps into your market.

If a married couple wishes to get the tax benefits for the EIC, ought to file their taxes mutually. Separated couples cannot both claim their kids for the EIC, thus they will end up being decide who will claim folks. You can claim the earned income credit on any 1040 tax guise.

Clients end up being aware that different rules apply once the IRS has already placed a tax lien against him. A bankruptcy may relieve you of personal liability on the tax debt, but individual circumstances won’t discharge a properly filed tax lien. After bankruptcy, the internal revenue service cannot chase you personally for the debt, but the lien stay in on any assets so you will not able to trade these assets without satisfying the outstanding lien. – this includes your domicile. Depending upon the lien and when filed, end up being be other new to attack the validity of the lien.